Visit the Homebuyers section of the OHFA website to learn how down payment and closing cost assistance helps make homeownership affordable.

Oklahoma Housing Finance Agency employees work toward the common goal of providing housing resources with an eagerness to serve. While each OHFA-administered program operates independently, they are often woven together. Programs intersect to create safe and affordable homes for Oklahomans in every corner of the state.

Access to affordable housing provides a foundation for individuals to thrive and improve their overall well-being. Housing is a fundamental need and a key determinant of health and success. We are grateful for the role we play each day in providing housing stability for Oklahoma families.

OHFA's 2023 Annual Report highlights strides made by our agency this past year.

-Deborah Jenkins, Executive Director

OHFA Operations Return to Renovated Building

In 2023, Oklahoma Housing Finance Agency team members returned to our newly remodeled home at the corner of N.W. 63rd and the Broadway Extension. For the first time in more than two years, we are all under the same roof - collaborating and working together for a singular goal: creating housing opportunities for the residents of the State of Oklahoma. Since OHFA first opened its doors in 1976, our team has worked diligently to open doors to homes in Oklahoma. This is our OklaHOME.

State Legislature Passes $215 Million Oklahoma Housing Stability Program

When the Oklahoma State Legislature passed HB 1031X in a special session at the end of June, we rolled up our sleeves and went to work drafting a blueprint for the Oklahoma Housing Stability Program. With $215 million allocated for new construction of for-sale houses, multifamily rental communities, and down payment assistance, this represents the state's largest-ever allocation of state dollars dedicated to housing production. In early 2024 the program is up and running and accepting applications from housing developers.

Housing Stability Program Input Sessions

Through public input sessions, community meetings, and an online message board, OHFA heard from housing professionals and community members interested in seeing this new program take shape.

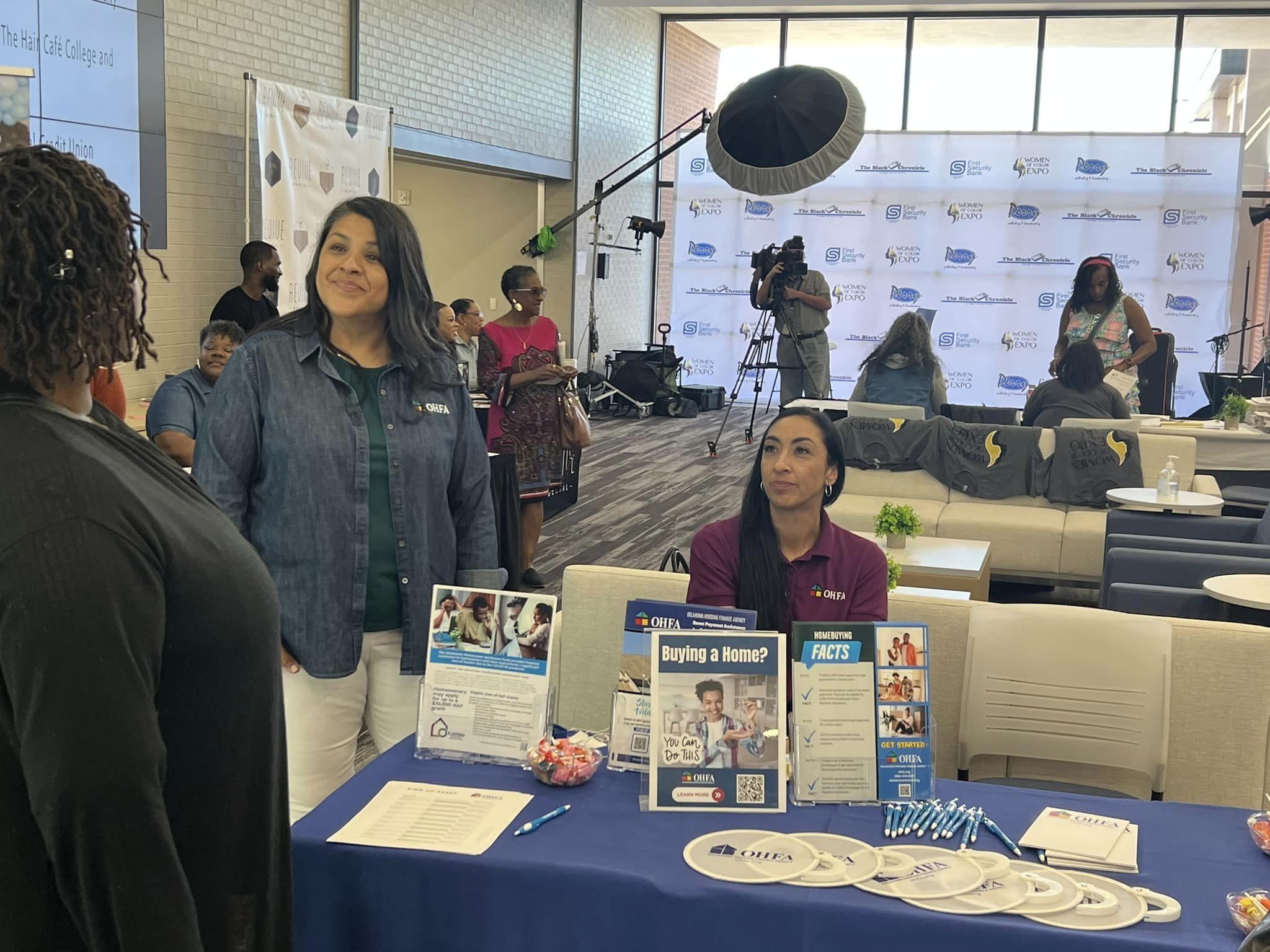

OHFA Programs Provide the Key to Achieving Dream of Homeownership

OHFA's Down Payment and Closing Cost Assistance program opened the doors to homeownership for 2,030 Oklahomans this past year. OHFA also created homeownership opportunities through Housing Choice Voucher Homeownership and the HOME Investment Partnerships Program.

Down Payment and Closing Cost Assistance

Using OHFA's down payment and closing cost assistance left room in Brooke's budget for other expenses related to homeownership such as repairs and furniture purchases.

Homeownership Program Highlights

OHFA helped 2,030 Oklahoma families become homeowners this past year. Dedicated Lending Partners and Blue Ribbon Realtors make it possible.

Leading Light Lending Partner Awards were presented to representatives of the top five producing mortgage lending institutions.

First United Bank & Trust - 242 homeowners

Associated Mortgage Corporation (AMC) - 215 homeowners

Gateway Mortgage Group - 136 homeowners

Great Plains National Bank - 124 homeowners

Stride Bank - 114 homeowners

OHFA's educational endeavors keep Participating Lenders and Blue Ribbon Realtors up-to-speed regarding down payment and closing cost assistance products. In 2023, approximately 400 potential homebuyers attended 27 Homebuyer Readiness Events hosted by partnering Lenders and Realtors. These events build relationships and play a key role in the introduction of down payment and closing cost assistance.

Learn More About Down Payment and Closing Cost Assistance

Homeowner Assistance Fund Helps Save Homes from Foreclosure

The COVID-19 pandemic may seem like ancient history to some of us, but thousands of Oklahomans are still feeling its lingering effects. The Oklahoma Housing Finance Agency continues to make an impact on the lives of Oklahoma homeowners at risk of losing their homes as a result of financial distress caused by the pandemic.

Oklahoma Homeowner Assistance Fund

OHFA continues to help Oklahoma homeowners who have been financially impacted by the COVID-19 pandemic. The Oklahoma Homeowner Assistance Fund offers up to $35,000 in grants to help Oklahomans save their homes from foreclosure.

Learn More About the Oklahoma Homeowner Assistance Fund

Visit the Homeowner Assistance Fund section of the OHFA website to learn more about how this program helps save the homes of Oklahoma homeowners impacted by COVID-19.

Voucher Programs Make Affordable Rent Possible

Through the Housing Choice Voucher and Performance Based Contract Administration programs, Oklahoma Housing Finance Agency helps more than 23,000 families with their rent each month. These two programs help address housing needs for low and extremely low income households.

Through the Family Self-Sufficiency Program, Housing Choice Voucher participants worked toward the achievement of personal and professional goals. Graduates of this program saved an average of $6,000 through their escrow, helping them to achieve self-sufficiency.

Housing Choice Voucher Program

Northwind Estates offers a close-knit community for seniors living in Tulsa. Approximately half of the apartments at Northwind Estates are occupied by Housing Choice Voucher Program participants.

Rental Assistance Highlights

In addition to assisting families with rental assistance each month, members of the Housing Choice Voucher staff also assisted families in times in crisis. In April, OHFA activated the Richard S. Lillard Emergency Housing Assistance Fund to assist households impacted by severe weather in April. Additionally, OHFA wrapped up its Emergency Housing Voucher initiative. As part of the American Rescue Plan Act, these vouchers assist individuals and families who are facing homelessness or fleeing domestic violence or sexual assault.

Performance Based Contract Administration staff members traveled the state, visiting communities in their portfolio. OHFA provides monitoring and payment services of assisted units to owners of project-based Section 8 properties for the U.S. Department of Housing and Urban Development in Oklahoma.

Learn More About OHFA's Rental Assistance Programs

Visit the Renters/Owners section of the OHFA website to discover how rental assistance programs help low-income families across the state.

Housing Development Programs Help Make Affordable Rent Possible

Affordable Housing Tax Credits and Multifamily Bonds

Affordable Housing Tax Credits and Multifamily Bonds helped the City of Moore create a vibrant community in an area devastated by a tornado.

Housing Development Highlights

OHFA's Housing Development Team is entrusted with allocation and compliance efforts related to several programs, including state and federal tax credits, the National Housing Trust Fund, the HOME Investment Partnerships Program, multifamily bonds, and the Housing Opportunities for Persons with AIDS (HOPWA) program.

Working with researchers from the University of Oklahoma through HOME-ARP, created a statewide map of resources available to unhoused and housing-insecure Oklahomans.

Learn More About OHFA's Housing Development Programs

Visit the Developer Financing section of the OHFA website to discover how housing development programs finance the construction and rehabilitation of Oklahoma's affordable housing stock.

OHFA Employees Make an Impact

For OHFA employees, the mission of "providing housing resources with an eagerness to serve" extends beyond the work they do each day. They make a difference in the communities where they live and work through volunteer and financial contributions.

OHFA Employee Accomplishments

Learn More About OHFA

Visit the OHFA website to learn more about Oklahoma Housing Finance Agency and its programs.

Board of Trustees

Michael Buhl, Chair

Scott McLaws, Vice Chair

Roger Beverage, Secretary-Treasurer

Ann Felton Gilliland, Member

Darin Dalbom, Member

Joi Love, Resident Board Member

Leadership Team:

Deborah Jenkins, Executive Director

Kurt Fite, Deputy Executive Director/CFO

Darrell Beavers, Housing Development Programs Director

Valenthia Doolin, Homeownership Programs Director

Mary Hoock, Interim Rental Programs Director

Tamara Steele, Human Resources Director

Financial Statements

The Oklahoma Housing Finance Agency shares its financial standing through the release of audited financial statements.